NORTHRIDGE, Calif., March 01, 2021 (GLOBE NEWSWIRE) — via NewMediaWire – Innovative Payment Solutions, Inc. (OTCQB: IPSI) (“Innovative” or the “Company”), a Southern California based fintech company focused on building a 21st century digital payment solution, IPSIPay, today announced that it has signed a Service Agreement with Interface Investment Capital, LLC (“IIC”) https://interfaceic.co – an investment and management company specializing in funding and management of agricultural businesses, while staffing almost 600 employees.

This agreement will facilitate Innovative’s entrance into agriculture and farming, one of the largest industries in California, by offering to IIC financial payment services, integration of IPSIPayroll ecosystem with the current accounting and payroll IIC infrastructure, payroll debit cards to employees, thus eliminating paper check writing, and real time management of debit cards spending. IIC employees will have access to payroll prepaid debit cards, cross-border payments infrastructure, significantly lower cost for international remittances via IPSICoin, and financial payment services that include unbanked and underbanked customers.

According to data provided by Employment Development Department, State of California, California Agricultural Employment 2019 Annual Average was slightly above 422,000 thousand workers. The research conducted by Gary Keough, Director, NASS Pacific Region in Research and Science, California is ranked No.1 in sales of agricultural products totaling more than $45 billion and accounting nearly 12 percent of the United States total sales.

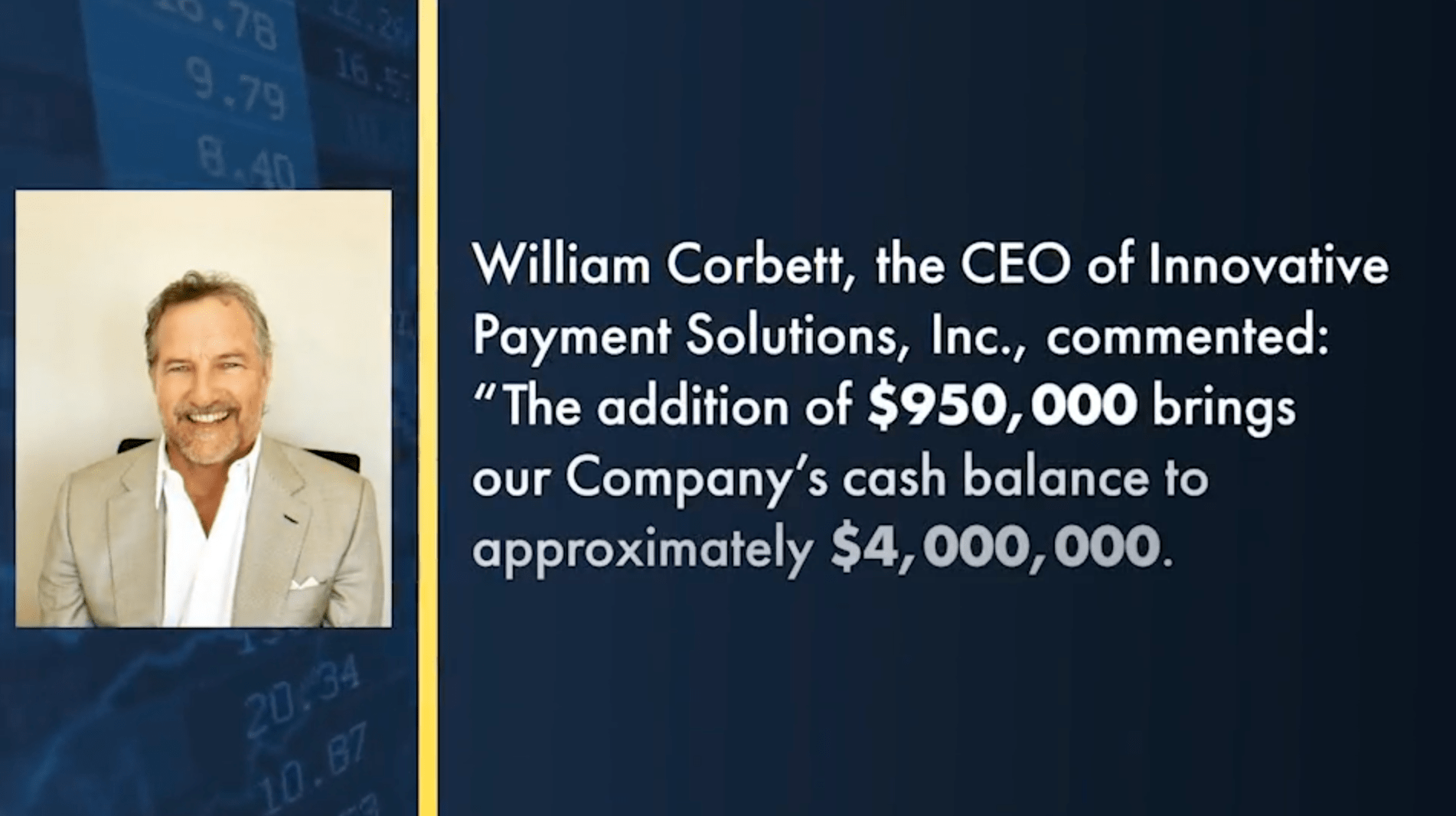

William Corbett, CEO of Innovative Payment Solutions, Inc., stated, “I am extremely delighted about the Service Agreement we have signed with Interface Investment Capital, LLC as it will give our Company an opportunity to provide comprehensive financial services through our IPSIPay ecosystem, and it is marking yet another significant milestone for our Company. This Agreement will allow us to utilize our advances in digital payments and mobile technology and make financial services more inclusive and affordable while providing the total solution for unbanked and underbanked communities in California and abroad.”

Todd Owen, CFO of Interface Investment Capital, LLC, added, “We look forward to working with Innovative and have chosen their services as a unique opportunity to integrate our existing financial infrastructure with IPSIPay ecosystem. We believe that total solution offered to our Company will enable us to reduce our operating costs and simplify financial operations while providing our employees digital payments infrastructure that will comprehensively advance their ability to manage their funds in the most secure and cost-effective way.”

About Innovative Payment Solutions, Inc.

Innovative Payment Solutions, Inc. strives to offer cutting edge digital payment solutions for consumers and service providers. Innovative’s ecosystem will span multiple devices such as self-service kiosks, mobile applications and POS terminals offering alternative payment methods to meet the needs of consumers and service providers. (investor.ipsipay.com)

About Interface Investment Capital, LLC

Interface Investment Capital, LLC is a robust consulting firm which works with executives and family offices to accelerate their vision and take businesses to the next level. The company facilitates mergers & acquisitions, real estate development, business development, renewable energy projects, private and public monetization programs, financing, capital structure, creative marketing, business scaling & exit strategies.

SAFE HARBOR STATEMENT

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statement of historical fact contained in this press release are forward-looking statements. In some case, forward-looking statements can be identified by terminology such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate, “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” or “will” or the or the negative of these terms or other comparable terminology and include statements regarding this agreement acting as a facilitator for Innovative’s entrance into agriculture and farming, by offering to IIC financial payment services such as, integration of IPSIPay ecosystem with the current accounting and payroll IIC infrastructure, payroll debit cards to employees, thus eliminating paper check writing, and real time management of debit cards spending, statements regarding IIC employees having access to payroll prepaid debit cards, cross-border payments infrastructure and significantly lower cost for international remittances via IPSICoin, and financial payment services that include unbanked and underbanked customers.

These forward-looking statements are based on expectations and assumptions as of the date of the press release and are subject to a number of risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectation include, among others, our ability to provide comprehensive financial services through our IPSIPay ecosystem, and to mark yet another significant milestone for our Company, our ability to utilize our advances in digital payments and mobile technology and make financial services more inclusive and affordable, while providing the total solution for unbanked and underbanked communities in California and abroad, IIC’s ability to integrate their existing financial infrastructure with IPSIPay ecosystem, their ability to utilize IPSIPay total solution to enable IIC to reduce its operating costs and simplify financial operations, while providing its employees digital payments infrastructure that will comprehensively advance their ability to manage their funds in a most secure and cost-effective way, our ability to expand our market share within the underserved communities, our ability to expedite the integration of our money remittance platform announced with our partner Golden Money Transfer, Inc., our ability to launch our kiosks rollout program in Southern California as has been previously planned before COVID-19, our ability to position Innovative for future profitability, the duration and scope of the COVID-19 outbreak worldwide, including the impact to the economy in California and Mexico, and the other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and the Company’s subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this release is provided only as of the date of this release, and the Company undertakes no obligation to update any forward-looking statements contained in this release on account of new information, future events, or otherwise, except as required by law.

For investor inquiries please call (818) 864-4004 or email [email protected]